- Wed, 4 March 2026

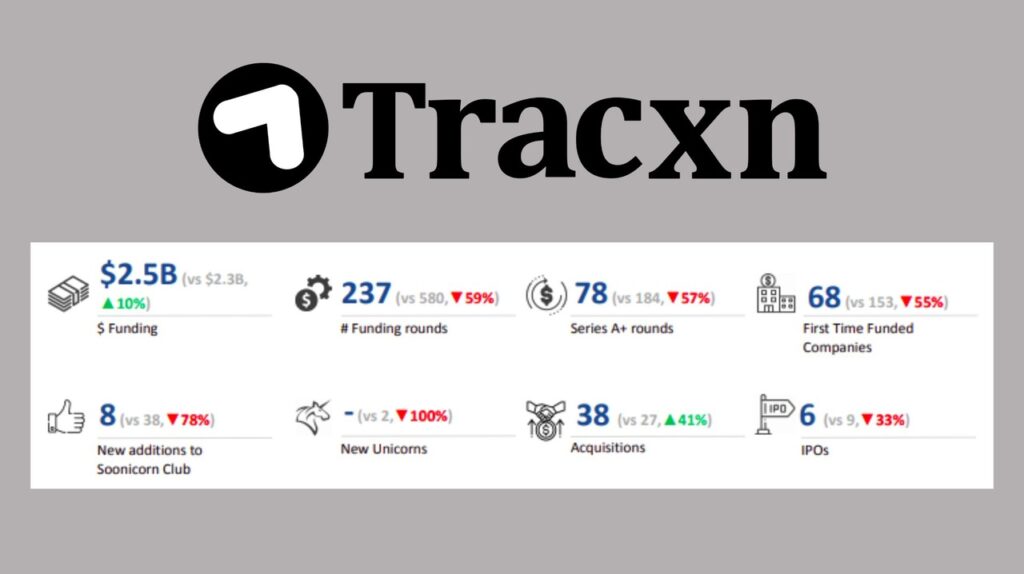

A recent report by Tracxn, a leading market intelligence platform, reveals that Indian tech startups raised $4.8 billion in the first half of 2025, marking a 25% decline from $6.4 billion in H1 2024.

Despite this drop, India climbed from 4th to 3rd place globally in terms of startup funding, overtaking Germany and Israel. The United States and the United Kingdom continue to hold the top two positions.

Unsurprisingly, Bangalore led in terms of funds raised, attracting $1.2 billion, solidifying its reputation as the hub of India’s startup ecosystem.

Some of the largest funding rounds that contributed to India’s total startup funding in H1 2025 include:

In H1 2025, startup funding in India declined across all stages compared to H1 2024.

Top Indian investors in H1 2025 included Venture Catalysts with 13 investments (354 total) and IIMA Ventures with 6 investments (341 total), reflecting continued support for early-stage innovation despite the funding slowdown.

In H1 2025, Transportation and Logistics Tech led the way, raising $1.6B, up 104% from H2 2024. The Retail sector followed with $1.2B, showing a 25% rise from H2 2024 despite a year-on-year dip. Enterprise Applications raised $1.1B, marking a decline from both H1 and H2 2024.

India is home to 119 unicorns, while the United States leads globally with 1,046 unicorns, highlighting a gap but also India’s growing presence in the global startup ecosystem.

Investments in unicorns declined notably in H1 2025, with the average funding before reaching unicorn status falling from $151 million to $56.5 million.

Additionally, the average number of funding rounds before achieving unicorn status dropped from 10 to just 2, reflecting a more compressed and selective funding trajectory.

The two new unicorns funded in H1 2025 were JSW One MSME (founded in 2020, Mumbai), which raised $65 million, and Juspay (founded in 2012, Bengaluru) raised $106 million.

Several top Indian startups exited the unicorn club through IPOs in H1 2025, such as Nykaa, Zomato, and Paytm.

Out of 89 unicorns that disclosed financials as of March 2024, only 26 were profitable. Leading the pack in profitability were fintech and retail players like Zerodha, CoinDCX, OfBusiness, Infra.Market, and Oxyzo.

Bengaluru – $1.2B (H1 2025), down from $2.4B (H2 2024)

Top deals: Udaan ($75M), CRED ($75M), SpotDraft ($54M)

Delhi – $1.2B (H1 2025), up from $613M (H2 2024)

Top deals: Erisha E Mobility ($1B), Euler Motors ($75M), Innov8 ($12.7M)

Mumbai – $822M (H1 2025), down from $923M (H2 2024)

Top deals: GreenLine ($275M), Truemeds ($44M), APAC Group ($42.5M)

Gurugram – $479M (H1 2025), down from $576M (H2 2024)

Top deals: Spinny ($141M), InsuranceDekho ($70M), Geniemode ($50M)

Thane – $248M (H1 2025), up from $130M (H2 2024)

Top deals: Infra.Market ($222M), Kult App ($20M), InspeCity ($5.6M)

Neha Singh, co-founder of Tracxn, said, “While the funding volumes have come down compared to the previous year, India’s tech ecosystem continues to show resilience and maturity.

Imagine a startup world where even with less money coming in, India still moves ahead — that’s what happened in H1 2025. Startup funding dropped to $4.8B, but India rose to 3rd place globally, showing the strength of its ecosystem. New unicorns like JSW One MSME and Juspay, big IPOs, and major acquisitions prove that startups are still growing.

The focus is now on smart, steady growth and building strong businesses, showing that India’s startup story is far from slowing down.

[Credits for header image: AsiaTechDaily

This content is for informational purposes only and does not constitute legal, financial, or investment advice. This has been constituted based on third-party sources. We do not assume any liability for actions taken based on this information.]

contact@GrowthSenseNews.com

Sign up to get exciting updates through our newsletter- your one-stop for all things startup!